Investing in a profitable property should be one of the biggest financial decisions of your life. You may have extensive financial knowledge about property investment, but without understanding the current market scenario, your investment can go worthless.

Many first-time investors are tempted by attractive, quick-profit promises, but later realize they have made a mistake and face a huge loss. Before you invest in property, take a deep dive with the top

property investment companies UK. It will help you to learn the property market like an expert and make the best decision regarding your investment purposes.

Let's explore this blog to know how to read the property market before making your first investment.

Read the Property Market before Your Investment

Whether you are a first-time investor or an experienced one, you have to learn the property market in detail to avoid any financial loss. Let's discuss some important facts in detail-

1. Understand the market cycle

The property market moves through growth, stagnation, decline, and recovery. Each stage has unique significances and opportunities.

• During the growth stage of a property, prices rise and demand increases.

• In the stagnation phase, prices are stable, which is a good time for negotiation.

• The decline stage offers bargains in time, indicating future appreciation in property prices.

• The recovery phase indicates a market rebound, which is perfect for smart investors.

If you target any property, you must track it for at least 12 to 18 months before final purchase.

2. Understand the local demand and rental yields

When you invest in buy-to-let property, your rental income comes from consistent rent. Apart from property prices, you must focus on rental yields. It will help you to take profitable action for your rental income. You should also focus on vacancy rates, infrastructure growth, and tenant profiles before investing in buy-to-let rental property.

3. Compare the property's growth potential

A smart investment always depends on the right comparison. Try to search for any upcoming business parks or government projects. If it happens, the property prices will automatically increase in the long run.

If the place has any historical significance, the property price also increases automatically. You can use tools like property portals, local authority plans, and Google Maps to understand the future potential of that area.

4. Focus on interest rates and market policy

In the event of a financial crisis, the best property deal is hampered. Try to monitor the home loan interest rates, government policies, tax benefits, employment rates, and inflation's impact on property demands. These factors are highly essential for

property investment UK and take a dynamic decision regarding property purchase.

Conclusion

Always remember: your knowledge should be your best potential. When you invest in the real estate market, always choose the right property at the right time and the right place. In such a case, Galaxy of Homes can help you significantly by providing the best investment advice, saving you time and money.

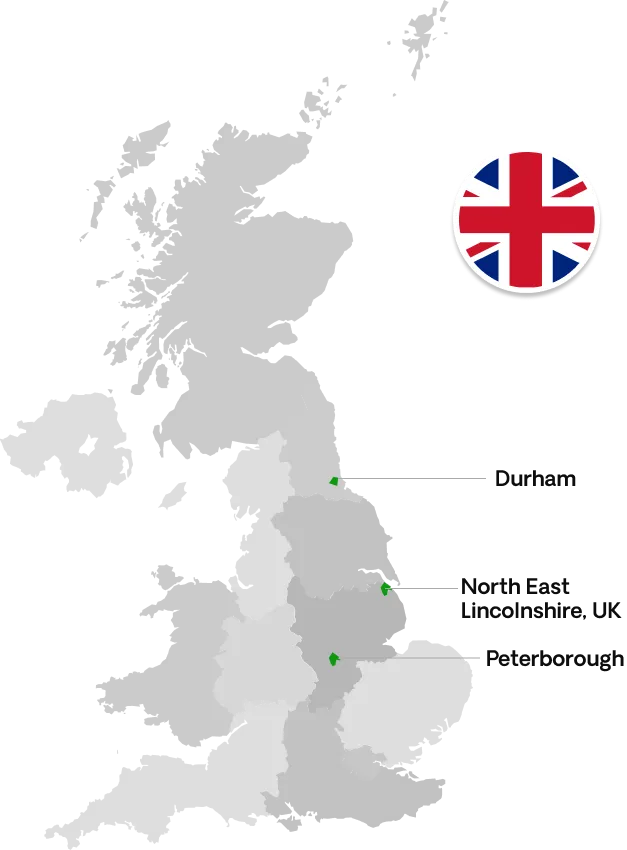

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091