Purchases

Purchasing the right property depends on several key factors. Let’s quickly identify the key factors behind property investment in the UK. Several factors are essential to determining a property's efficacy. Location, changing property prices, refurbishment needs, and average rental yields are among them.

What makes us capable of sourcing the most appropriate property? It’s an extraordinary network that enables us to complete the entire process effortlessly. With a team of highly skilled property experts, we help our clients secure the best properties.

Where We Invest?

Do you know how to expand a UK property investment portfolio to get immediate equity? The answer is simple. We need to identify areas with high capital development needs and secure discounts. We must target properties that appeal to long-term tenants. It can help the owner prevent hassles and unnecessary expenses. Galaxy of Homes offers services across the northern UK, including Cleethorpes and Grimsby.

Sourcing the Properties

Are you looking forward to purchasing a property in the UK? If yes, connect with us. But why rely on our best property sourcing company in the UK? We conduct precise property research to save you valuable time. There will be no need to scroll through multiple websites.

In addition, we can help you stay up to date on the latest market trends. As a reputable brand, we also ensure below-market-value agreements on all off-market properties. Let’s explore a remarkable one stop shop for UK property investment with Galaxy of Homes.

PROPERTY

INVESTMENT

WEBINAR

Got a question?

Click on the ‘Leave a message’ button and drop us your query. Our experts will get back to you.

Leave a message

Handling Communications

Are you a landlord? The Galaxy of Homes is a one-stop shop for property investment via a limited company in the UK. It’s because we offer unique customized property solutions. We can do everything related to property investment, including the following.

- Property refurbishments

- Property purchase

- Finding the benefits

- Tax filing

- Accounting

- Property sales

Contacting us means no need to juggle multiple teams. We can handle all the hurdles by establishing effective communication.

Solicitor or Mortgage Support

Unlocking the door to landlord success is challenging but not impossible. There are several ways to do so. A buy-to-let mortgage is notable among them. With Galaxy of Homes, you now understand how to earn passive income and enjoy the benefits of regular rental income and a result-driven investment.

But before you start, you must unlock the details of buy-to-let investment in the UK. Most rules of buy-to-let and regular mortgages are almost similar. There are very few differences in lending criteria, eligibility, and affordability.

JOIN OUR WEBINAR

Frequently Asked Questions

Please attend the webinar of our best property sourcing company in the UK if you wish to make a buy-to-let deal with us. After the webinar, our team will add you to our WhatsApp Broadcast Group. This group will help you secure exciting deals through us.

Purchasing property in the UK entirely depends on your requirements. Your risk appetite and background are essential as well.

You must finance your investment either with a mortgage or in cash. Always invest in category-3 properties. It will help you get the optimal capital gain. Later, you can select category-2 and category-1 properties to maximize profits.

If you invest in one of the best property investment companies in the UK by cash purchase, you must pay the total amount on week 12 of the purchasing process or the completion date. However, we recommend a property investment secured by a 2-5-year mortgage.

You can choose any one of these two. However, the tax structures differ between the two options. An Ltd company always has higher interest rates. So, if one partner is in a more oversized tax bracket and the other is smaller, you can go for a 99:1 ownership investment ratio. We can handle the entire process efficiently.

Yes, you can invest in a personal name business in your wife's name if she is in a lower tax bracket. However, if your income and your partner's income exceed £ 50,000 per annum, it is always better to form an Ltd company as an SPV for investment.

Galaxy of Homes offers three types of investment properties for sale in the UK, including the following.

- Category 1: investment £42-44K, rent- £450 PCM, price-£50-65K.

- Category 2: investment £46-48K, rent- £475-525 PCM, price-£65-80K.

- Category 3: investment upwards of £48-50K, rent- £525-575 PCM, price-£80K+.

If you want to buy more than one property from us, the buying ratio (average) should be2(Category-3):2(Category-2):1(Category-1). The rest depends on the realities of the buyer at the time of investment.

Yes. We, as a trustworthy brand, offer Galaxy Discover tours on weekdays. On those days, we take our clients to our 10000 square feet office and hold small get-togethers with our employees. We also offer the landlords a drive to show several zero-refurbished, semi-refurbished, or fully refurbished properties.

There are specific notable reasons for investing in properties in North England. Those properties are cheaper than in the southern or eastern parts of the UK. Rental demands are higher in the northern part of the UK than in other parts. In the northern parts, capital appreciation is also fruitful. Hence, you can receive a decent capital and rental yield in that part after investment.

There are three types of investment properties for sale in the UK.

- Category 1: investment £42-44K, long-term capital gain - low, rental income – high.

- Category 2: investment £46-48K, long-term capital gain - medium, rental income – medium.

- Category 3: investment above £48-50K, long-term capital gain - high, rental income – medium.

Among these types of properties, the choice is entirely yours. The purchasing appetite, mode of purchase, risks, and funding will aid you in selecting an option.

Yes.

Yes. Galaxy of Homes serves clients from countries like Australia, Singapore, Hong Kong, Netherlands, UAE, etc.

Yes. Galaxy of Homes has a fully furnished office in Kolkata, West Bengal, India. With experienced directors and other teammates, we can take care of all of your needs for buy-to-letproperty investment in the UK.

Yes. You can join the webinar if you don’t know English well. Our directors deliver all the information in simple language so everyone can understand.

You can’t purchase property in your child's name unless they are adults. But you can keep them in the joint name. We recommend not doing so, as it can destroy all their benefits as a first-time buyer. Your child may not get the stamp duty exception in the future.

If you don't invest now, you may lose by 18%. The 9% inflation rate will strike your investment and make the capital lose. You may also lose a 9% rental return if you don't invest in the buy-to-let market. So, you can experience a total of 18% loss.

If you invest in a deposit and get a good income, you can borrow 75% of the buying price. For example, if the property price is £60000, the bank will offer you 75% of £60000, which is £45000.

Yes, your parents can aid you financially. They can gift you funds as a part of the mortgage process. The lenders will require them to sign a gift deposit later. Close family members like your parents can transfer their savings to an account related to a family offset mortgage. Always seek professional guidance in such matters.

Yes. We are a trustworthy brand that can keep all your details safe and confidential.

No, you can't. You must pay your deposit only from personal savings or a company transfer.

If you are from overseas, visiting a property is unnecessary. We can perform everything remotely. You can get your earnings in your international bank account. However, mortgage services are not available if you're an outsider.

If you are a prospective landlord, we will send you all the property investment deals via WhatsApp to the Ltd company. Then, select and lock the most suitable one by replying to us. Always fill out all the crucial information like name, address, email ID, and phone number with £2100 as a 50% fee.

People from overseas can develop a company in the UK and buy properties under that company name. But they cannot get a mortgage if they don't have a British passport.

Hiring a property investment company in the UK or a letting agent is necessary. Local knowledge and expertise are essential while investing in buy-to-let properties. We know all the property types and the ways to achieve them. We will also find you the ideal tenants. Our effective services can help you avoid distressing and expensive mistakes.

No. It's because Galaxy of Homes follows a particular model. It won't work if your property is already on the market. However, some exemptions can happen in some chosen cases.

not everyone can invest in buy-to-letproperty investment in the UK if they are on a temporary visa in the UK.

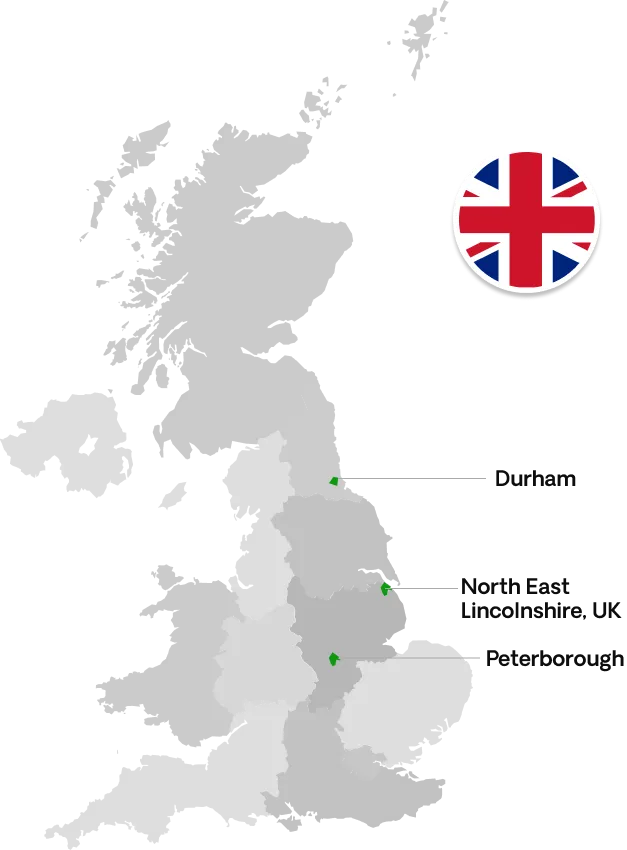

Our Offices

Peterborough, UK

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

North East Lincolnshire, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Durham, UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Kolkata, India

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091