Join Our Webinar

Buy-to-let mortgages get easier for HMO landlords as lenders adapt their criteria to better reflect the realities of the rental market. With energy efficiency rules tightening and borrowing costs still a concern, recent changes are opening up new funding options for investors who had previously faced restrictions.

One of the most notable shifts comes from Pepper Money, which has introduced a more pragmatic approach to EPC requirements while also cutting rates across its buy-to-let range.

Lenders are increasingly recognising that rigid criteria can limit good-quality rental supply. As a result, buy-to-let mortgages are becoming more flexible, particularly for specialist property types such as Houses in Multiple Occupation (HMOs).

Recent enhancements focus on:

This shift supports landlords operating in older housing stock, where achieving top EPC ratings can be challenging in the short term.

A key development for landlords is the growing availability of EPC D rating mortgage options. Previously, many lenders restricted lending to properties with EPC ratings of A to C, limiting finance for otherwise strong HMO investments.

Accepting EPC D (and E) properties:

HMOs often operate in converted or older buildings. Greater flexibility allows landlords to focus on yield, tenant demand, and compliance, while planning energy upgrades over time instead of delaying purchases or refinances.

Modern buy-to-let property financing is increasingly centred on rental performance rather than personal income. For many landlords, this is a major advantage.

Affordability is commonly assessed using:

ICRs measure whether rental income comfortably covers mortgage payments. This approach benefits:

It also allows landlords to scale portfolios without being constrained by traditional income multiples.

Alongside criteria changes, BTL mortgage rates have become more competitive. Recent reductions across two- and five-year fixed products provide landlords with improved options for managing costs.

Lower rates help investors:

The right choice depends on risk appetite, portfolio plans, and refurbishment timelines.

These developments are particularly relevant for:

Buy-to-let mortgages get easier for HMO landlords as lenders relax EPC rules, improve affordability assessments, and sharpen BTL mortgage rates. For investors, this means greater flexibility, broader property choice, and improved access to funding—key advantages in a competitive rental market.

If you are considering expanding your buy-to-let or HMO portfolio and want expert guidance through every stage of the investment journey, from property selection to financing, refurbishment, and ongoing management, Galaxy of Homes can help.

Our end-to-end, hands-on approach is designed to make property investing simple, transparent, and scalable for investors at every level.

Speak to Galaxy of Homes Today

Or visit www.galaxyofhomes.co.uk to learn more.

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

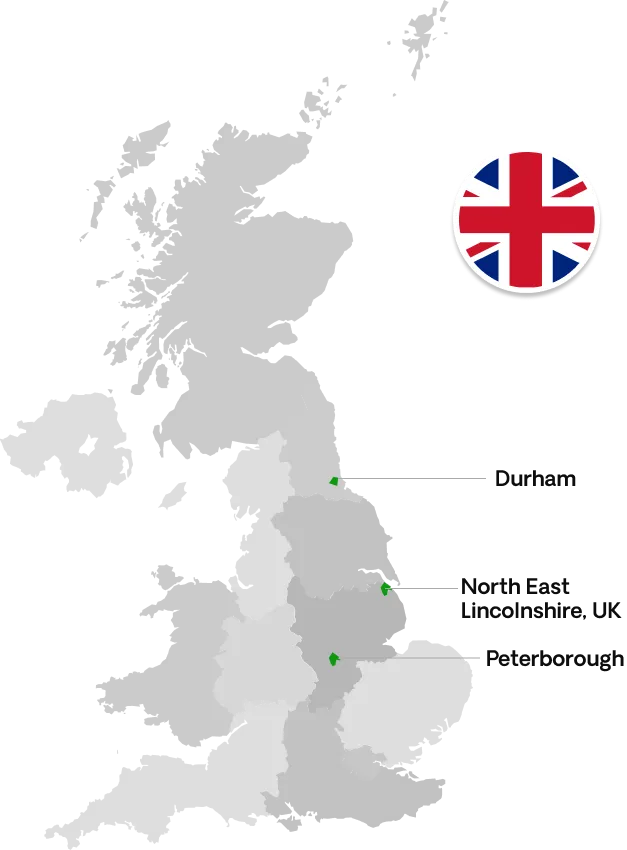

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091