Join Our Webinar

One of the best methods to earn extra money while pursuing financial independence is through real estate. With substantial dividends, returns on investment and capital growth, property is considered a tangible asset that appreciates in value. As a result, some investors firmly believe that real estate is the best investment available. Want to gain more knowledge about property investment? Then, the best property management company in the UK can help you.

Rental demand is rising as more people seek affordable housing. Many individuals are selecting to rent instead of buying. This trend creates excellent opportunities for property investors. They can earn steady rental income and potentially see their property values increase over time.

The acquisition of passive income through property requires a clear and educated mind. It involves the awareness of various aspects like the introduction of new laws, the rise in interest rates, the standards of energy efficiency and tax implications. Therefore, it is imperative to use the correct investment strategy for this purpose. In this article, we will give you a detailed analysis on how to earn passive income with property investments.

Real estate investment is an attractive way to make passive income in an emerging rental market in the UK. Effective planning will enable one to make money with ease.

Buy-to-let is an effective way to make money in the UK. Savvy investors buy homes and rent them out, earning steady monthly rent and benefitting from any rise in property value. The key to success is opting for the correct location. Look for popular rental areas such as university towns, commuter zones and improving cities. To keep things simple, many landlords hire letting agents to handle tenants, maintenance and rent collection. This helps create a hassle-free experience. With the help of the best property sourcing company in the UK, you can understand where to invest appropriately.

HMOs (Houses in Multiple Occupation) can help increase your passive income sources if they are managed in the right way. Letting out separate rooms would attract higher rental income compared to single-let properties, with every room earning income separately. Although it is important to consider regulations in this sector, it might save you time to work in collaboration with an expert in the management of HMOs. This type of property attracts many students, young professionals, or key workers, thus improving market potential.

REITs(Real Estate Investment Trusts) are an effective vehicle for earning passive income. With REITs, you can fund in real estate without owning and managing it. They give you regular dividend income from the rental income. You can trade REITs on stock exchanges and through this method, it will be very easy for you to purchase and sell them. REITs will help you diversify your investments. This could be the best option for beginners who want to invest in real estate without managing it.

Adding value can boost your passive income. Buying undervalued properties and improving them can increase rental income. Upgrades such as energy efficiency improvements, refurbishment of kitchens or adding bedrooms are very desirable. Once you renovate a property to rent it out, you are assured of earning more with less effort. It is a great approach when refinancing to borrow funds to invest in other ventures in the future.

Effective tax planning helps you make the most of your passive income. Using limited companies, pension wrappers or joint ownership can make your taxes more efficient. Pay attention to mortgage interest relief rules and capital gains tax. Working with accountants who focus on property can help you keep more of your income legally.

ConclusionEarning passive income from property investment in the UK requires careful planning and sound decision-making. Property investors can use buy-to-let properties, HMOs, serviced accommodation or resort to hands-off strategies. The investor ought to focus on locations with high rental yields, increase energy efficiency and ensure that they comply with long-term rules.

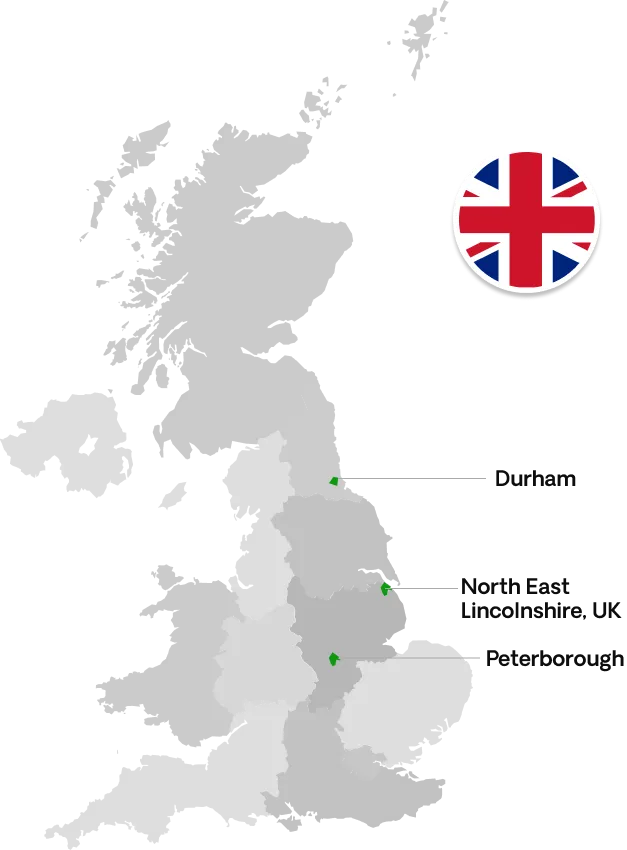

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091