Money is one of the trickiest assets to manage, which is why proper investment is crucial. Real estate investment and renting the space can be a perfect source of income, especially in the UK. But if a proper plan is not devised, there is a high chance that a significant amount of your income will go to taxes. Many landlords are often unaware of the allowances, reliefs, and strategies that can legally minimize their tax liability. It’s vital to understand how rental income is taxed and what expenses and deductions can be claimed. If you want to understand the details of property investment so that you can rent it properly, a

property investment company in the UK can help you.

For landlords, there has been a creative strategy developed that helps them increase rental revenues with minimized tax liabilities. Certain strategies even allow landlords to claim certain expenses, leverage mortgage interest relief, and organize their property to minimize taxes. This helps landlords make the most of their cash flow from rental revenues. Here, we will provide detailed information on how you can save tax on UK rental income. Let's start the topic.

Various Ways To Save Tax on The UK Rental Income

Earning rental income in the UK can be rewarding, but without proper tax planning, landlords may end up overpaying. Many property owners are unaware of the reliefs and allowances that can reduce profits. Understanding tax-saving strategies is essential for maximizing returns.

If you are in a higher tax bracket and your partner is not working, remember that your partner won’t owe any taxes. However, you can’t put the property only in your partner's name. To get a buy-to-let mortgage, you need to show an income between 10,000 and 20,000 pounds. The best option is to buy the property in both your names. Also, write a deed of trust to formally give 99% of the rental income to your partner. This will help you better manage your investment's finances. Want a clear-cut answer on

buy-to-let property in the UK? You need to consult the best investment company near you.

You can lower your taxable profits by deducting repair costs, insurance fees, professional service charges, and utility expenses from your rental income. This method can help you maximize your financial returns and make the most of the deductions available to improve your tax efficiency.

If you and your partner are in a high tax bracket, consider registering the property in a limited company. This means you'll pay corporation tax instead. However, keep in mind that interest rates for limited companies are usually higher than for personal names. There are only a few lenders for limited companies, and arrangement, product, and service fees are generally higher as well. Additionally, accounting fees for limited companies are also higher.

Real estate investment in renovations is a savvy strategy that helps reduce taxable rental income, thereby delaying tax payments. This is because it increases the property's value, making it easier for landlords to manage their finances. In addition, upgrading living conditions is a strategy that helps landlords raise rents, as more people are attracted to the improved conditions.

Conclusion

In order to minimize UK rental income tax, it is necessary to come up with a strategy, maintain proper records, and take advantage of the available tax reliefs. Such tax liability can be minimized and a landlord's revenue maximized by claiming the correct expenses, organizing ownership, and considering ownership through a company. If more help is needed, a professional can be consulted. Galaxy of Homes is a trustworthy place that will not only help you with property investments but also help you save on taxes from rental income. For more ideas, you can join our Exclusive Property Investment Webinar.

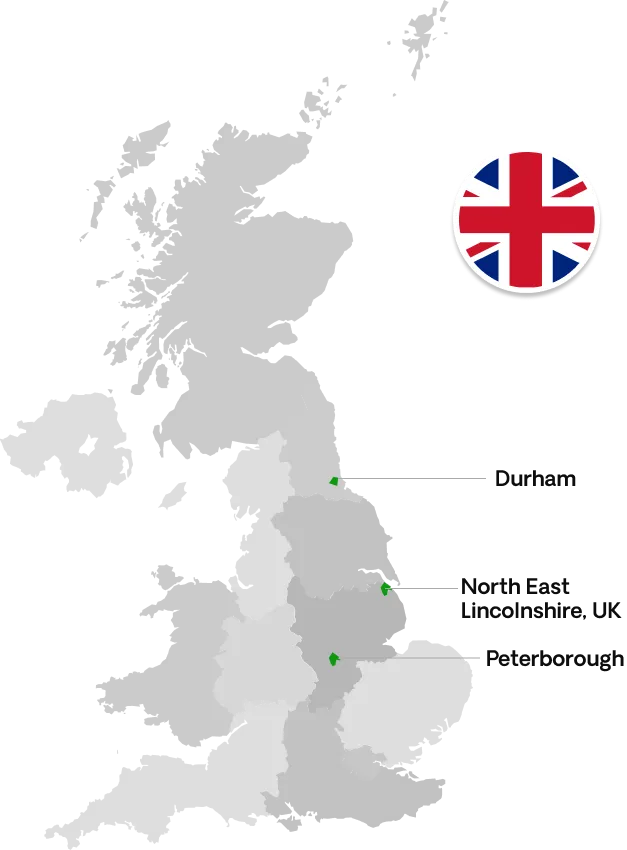

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091