Join Our Webinar

If you are thinking about buy to let UK in 2026, you are probably asking yourself one simple question: is buy-to-let still worth it?

It is a fair question. The last few years have brought higher interest rates, new regulations, and plenty of negative headlines. But when you look beyond the noise, the fundamentals of the buy-to-let UK market remain strong. Demand for rental homes is high, supply is limited, and well-planned investments are still delivering steady income.

At Galaxy of Homes, we work with investors every day who want clarity, not confusion. Here is what is really happening in the UK buy-to-let market and how you can respond with confidence.

One of the biggest shifts in the buy-to-let UK market is around tenancy rules. Fixed-term tenancies are being replaced with periodic agreements, and Section 21 evictions are being removed. This means landlords must rely on clear and lawful reasons if they need to regain possession.

At first glance, this can feel restrictive. In reality, it encourages longer tenancies and better tenant relationships. Longer stays reduce void periods, lower remarketing costs, and create more predictable cash flow.

Rent increases are still allowed, but they need to be fair and clearly communicated. For landlords who already manage their properties professionally, these changes are more of an adjustment than a threat.

Despite slower rent growth compared to previous years, tenant demand across the buy-to-let UK market remains strong. Many people are renting for longer durations due to affordability challenges and higher deposit requirements.

London continues to attract long-term renters, even though rent growth has stabilised. At the same time, regional cities and commuter towns are becoming increasingly popular with buy-to-let investors due to stronger yields and lower purchase prices.

This shift is healthy. It points to a more stable rental market where income is consistent rather than driven by sharp rent spikes.

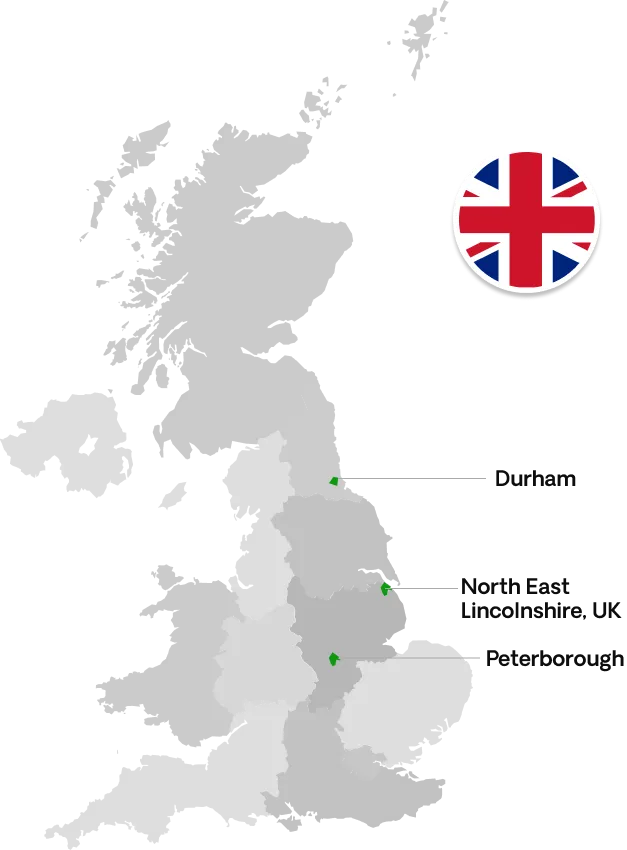

Beyond London, several regional locations are offering strong buy-to-let UK opportunities thanks to lower entry prices and steady tenant demand. Grimsby and Cleethorpes benefit from regeneration, port activity, and renewable energy investment. Scunthorpe and Immingham attract long-term tenants linked to industry, logistics, and trade.

Doncaster continues to grow due to improved infrastructure and strong transport links, while County Durham offers stable demand driven by universities, healthcare, and public sector employment.

At Galaxy of Homes, we actively source and manage buy-to-let UK opportunities across these locations, helping investors secure well-structured deals with confidence and clarity.

Buy-to-let UK is no longer a passive investment that runs on autopilot. But for investors who take a professional, informed approach, it remains a strong option for building long-term wealth.

Tenant demand is high, rental income is stable, and lending conditions are improving. Success now comes from choosing the right locations, understanding the rules, and structuring investments carefully.

Looking to invest in buy-to-let UK property with confidence? Galaxy of Homes provides end-to-end support, from sourcing the right locations to structuring and managing your investment for long-term success.

Explore Buy-to-Let Opportunities with Galaxy of Homes

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091