Long-term growth in the real estate industry is very much dependent on the identification of high-potential commercial assets. Success depends on assessing various properties for earning potential and sustainability, and how well they align with economic trends. Key areas will involve market data analysis, location, tenant quality, and property condition-all determining factors that will influence an asset to continue yielding consistent returns and appreciating over time. If you are seeking any help regarding your property investment, then enrol in the best

property investment webinar in the UK. There, you will get some idea about your investment.

In the competitive world of commercial real estate today, one needs an asset selection based on sound research. Since competition is getting tougher and investors' expectations vary, the knack for discovering high-value opportunities is gaining immense importance. By harnessing market insight, robust financial analysis, and forward-thinking evaluation, investors are confidently able to spot properties that outshine today and are resilient and adaptable to changes in future market conditions.

Various Steps to Identify High-Potential Commercial Assets

Commercial real estate investment involves identifying high-potential assets for strong returns and long-term value. In this context, an investor or developer must understand the elements that make up a profitable property. Precisely, the following should be considered in identifying, evaluating, and acquiring truly valuable commercial assets:

• Define your investment goal and strategy.

Not all commercial assets intrinsically serve the same investment objectives. You should further define your investment horizon, your risk tolerance, and of course, your desired asset type: office buildings, retail centres, industrial buildings, or multifamily properties.

By understanding how to approach the screening of opportunities, you will move with complete assurance that your search for investments is tailored to perfectly match both your financial and operational goals. If you are planning a

property rental yield in the UK, you need to consider this point.

• Assess location and accessibility.

Location is everything when it comes to property value and future growth. Look at how close the place is to public transit, offices, shops, or parks. And don’t ignore new roads or construction in the area, they can really change the game when you're choosing where to buy. The right spot brings in good tenants, keeps occupancy high, and boosts value over time.

• Assess tenant quality and lease terms.

The stability of the property income depends on the quality of the tenants and resilience in lease structures. There is a need for a full analysis of the existing leases, tenant creditworthiness, the duration of occupancy, and ensuring diversification of tenants.

This review confirms not only the reliability of cash flow but also points out possible risks: expiring leases or high tenant turnover. When you keep these factors in mind, you can look at the financial forecast for this real estate and actually feel sure about your assessment.

• Understand zoning and regulatory considerations.

Legal rules decide what you can actually do with your property and how much you’re allowed to change or add to it. So, look into zoning laws, get clear on any environmental restrictions, and make sure you’re not breaking any local building codes. Want to switch up how you use the place? Double-check those rules first, or you could run into problems fast.

• Talk to the planning authorities first.

The most important thing is that this proactive step will not only help you avoid costly legal problems but also guarantee that the property's intended use will marry with local policy seamlessly.

Conclusion

The identification of high-potential commercial assets requires a strategic balance between market insights, financial analyses, and foresight. The basis of that decision should reflect, with care, location, tenant quality, economic performance, and growth potential, in addition to professional due diligence, to confidently identify properties that enable strong ongoing returns with lasting value. Whether you are expanding a portfolio or making your first foray into the real estate market, these critical steps will enable you to make an educated, profitable, and future-ready investment decision.

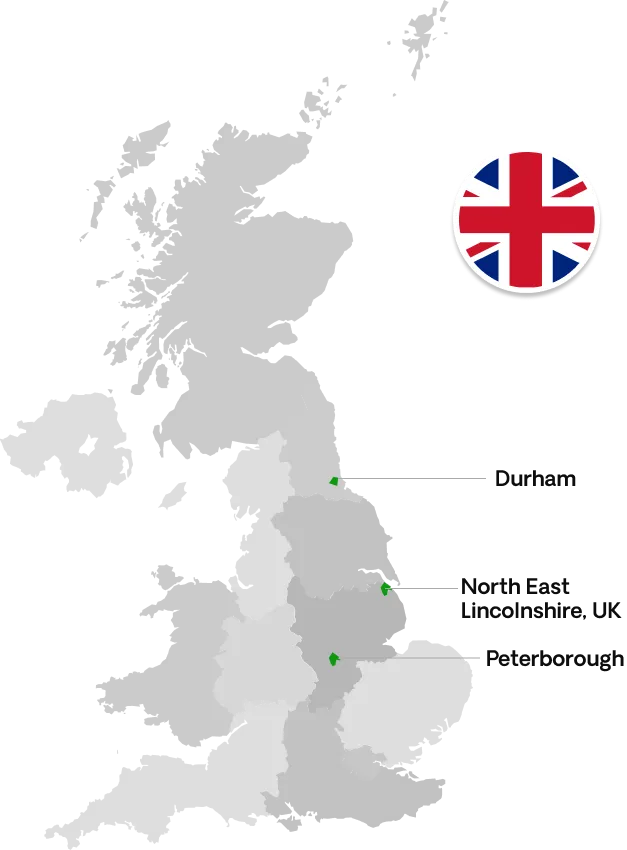

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091