Join Our Webinar

The UK property market has long been a popular avenue for investors seeking long-term income and capital growth but the landscape is evolving as we sail through 2026. Rising interest rates, driven by inflationary pressures and broader economic adjustments, have prompted many potential investors to reconsider the viability of buy-to-let property investment UK as a proven strategy. With mortgage costs increasing, the appeal of rental income versus property appreciation is being weighed more carefully than ever before.

Despite these challenges, buy-to-let still presents opportunities for those who approach the market strategically. The underlying demand for rental properties, particularly in urban centres and areas with strong employment growth, remains robust. Tenants continue to seek quality homes and demographic trends such as younger professionals delaying home ownership, ensure that rental demand persists.

This blog explores whether buy-to-let remains a worthwhile investment in 2026. We will examine the impact of rising interest rates, consider the factors that influence rental yield and capital growth and discuss strategies that can help investors mitigate risk and maximise returns. By understanding the current market dynamics, prospective landlords can make informed decisions about entering or expanding in the buy-to-let sector.

Interest rates have risen significantly in recent years affecting the cost of borrowing for buy-to-let investors. Higher mortgage rates increase monthly repayments, reducing cash flow for landlords and potentially affecting the profitability of rental properties. Those relying heavily on leveraged investments need to factor in these costs carefully when calculating expected returns.

However, rising interest rates do not automatically render buy-to-let property investment UK unprofitable. Many investors hold properties with long-term value appreciation potential or in areas where rental demand remains strong. In such cases, rental income can still cover mortgage costs and provide a steady income stream, albeit at lower margins. Moreover, investors with fixed-rate mortgages benefit from predictable repayments, insulating them from further short-term rate increases.

It is also worth noting that interest rate rises often coincide with slowing property price growth. This may present opportunities for new investors to enter the market at more reasonable prices, especially in regions outside the traditionally expensive London market. Understanding local market conditions and identifying areas where rental demand is high are crucial steps in managing the risks associated with higher borrowing costs.

Rental yield, the annual rental income as a percentage of property value, remains a key consideration for buy-to-let investors. In regions where demand exceeds supply, yields can remain attractive even with higher interest rates. Cities with growing employment opportunities, universities and strong rental demand are likely to offer better returns.

Investors should consider gross and net yields carefully. Gross yield provides a snapshot of potential income while net yield accounts for costs such as mortgage payments, maintenance, insurance and management fees. Rising rates primarily impact net yields, so accurate calculations are essential to understanding realistic profitability.

Diversification within the property portfolio can also help. Buy to let investing in a mix of property types, such as single-family homes, HMOs (houses of multiple occupation) and purpose-built flats may offer more consistent returns and reduce exposure to market fluctuations. By targeting areas with a proven track record of rental demand and stable prices, investors can maintain positive cash flow even in a higher-rate environment.

While rental yield is important, investors managing buy-to-let property investment UK also often consider long-term capital growth. Properties in regions with strong economic fundamentals, infrastructure development and population growth typically appreciate over time, providing additional value beyond rental income.

Rising interest rates can moderate price growth but they do not eliminate it. Strategic property selection, choosing locations with good schools, transport links and community amenities, can help ensure properties remain attractive to tenants and potential buyers in the future.

Moreover, long-term investors benefit from the compounding effect of property value increases. Holding properties over several years allows for the smoothing of short-term fluctuations in the market which may occur due to rate changes or other economic factors. Careful planning and a focus on areas with solid fundamentals remain crucial to achieving capital growth despite higher borrowing costs.

Buy-to-let investors in 2026 face several challenges, but these can be mitigated through careful planning:

Despite rising interest rates, there are emerging opportunities in the buy-to-let market. Areas outside of London and the South East are attracting increased interest due to affordability, strong rental demand and improving local economies. Cities like Manchester, Birmingham, Leeds and Bristol continue to see robust tenant demand, particularly among young professionals and students.

The growth of flexible working arrangements also affects rental trends. Many professionals now seek homes in commuter towns or suburban areas with better space and amenities, potentially opening new markets for buy-to-let investors. Those who can identify and capitalise on these trends may find opportunities to secure attractive yields and long-term growth, even in a higher-rate environment.

Buy-to-let property investment UK remains a viable investment option in 2026, despite rising interest rates, but success depends on strategy, planning, and careful market analysis. By focusing on areas with strong rental demand, calculating yields accurately, and managing risks through fixed-rate mortgages and diversified portfolios, investors can still achieve stable returns and potential capital growth.

If you’re interested in learning more about making the most of buy-to-let investments in the current market, we invite you to reach out to us at Galaxy of Homes. At Galaxy of Homes, we provide guidance, resources, and insights to help our clients navigate the property market effectively, ensuring our investors make informed decisions. Let us help you explore opportunities in the buy-to-let market, understand the challenges, and develop strategies to achieve your investment goals.

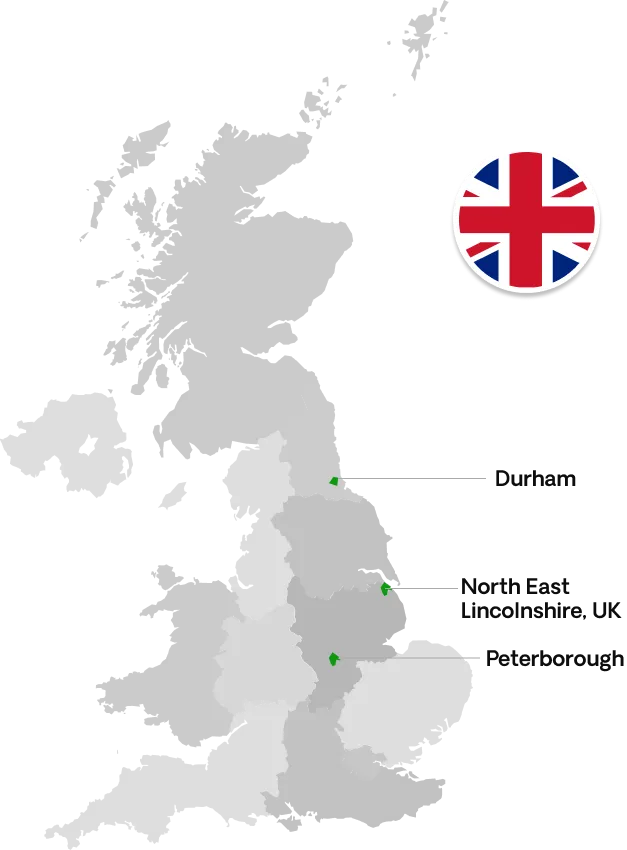

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091