Being a landlord of a rental property in a profitable location is such a blessing. Do you agree with us? Though high interest rates, complex mortgage terms, and tax rates may not be favorable for rental property investors, UK landlords can still earn a higher return from rental property. If you take the help of any reliable

property management company UK, you will find a reliable property for investment purposes.

According to a recent report, rent across the UK is rising by nearly 8.5% in 2025. So, what do you think landlords are enjoying higher income from rental property? It might be an attractive figure, but due to minor, avoidable mistakes, you cannot achieve the highest return on your rental property.

Let's discuss this blog to know about the top 5 mistakes that UK landlords make that reduce their rental income.

5 Mistakes UK Landlords Make that Reduce Rental Income

In this segment, we will discuss the top 5 mistakes that UK landlords make that reduce their rental income.

1. Neglect regular home maintenance

If landlords ignore minor repairs in their property, they can lose money over time. A small plumbing leak or a damaged boiler system can result in expensive repairs. Poor property maintenance may lead to lower tenant satisfaction, reduced rental value, and increased vacancy rates.

If you want to avoid this scenario and make a profitable move for your rental property, create a regular maintenance schedule. Check plumbing and heating twice a year to keep the property in good shape and achieve a higher return.

2. Set the wrong price list

Due to overpricing or under-pricing, the landlord cannot achieve a higher return on the rental property. Overpricing leads to long-term vacancies, whereas under pricing results in inadequate income generation.

To get rid of this problem, you have to research the local rental property agents to analyse the market demand. In such a case, you must seek help from a professional rental property investment company that can drastically help you to find the best rental property and fix your rent.

3. Ignoring tax efficiency and legal aspects

UK property tax rules are changing continuously. Ignoring the change in mortgage interest relief to capital gain tax adjustments can lead to huge losses from rental income.

In such a scenario, if you take help from the

largest property management companies UK, you will get complete guidelines on how to ignore the tax burden from rental property and earn adequate income.

4. Poor quality tenant

Apart from all legal formalities, checking the tenant's quality is vital to generating higher income from rental property. A bad tenant can miss your monthly payment, damage the property, and give you legal troubles.

If you really want to avoid these negative scenarios, you must take help from the property management company, which will find the best tenant on your behalf. After the credit check and employment details verification, the property management company let the tenant into the property.

5. Overlook the review of the insurance paper

If a UK landlord lets a property for rental purposes without verifying the mortgage deal, it can drain your annual income. In case of inadequate insurance coverage, your profit margin from rental property will decrease.

In such a case, it is vital to review your buy-to-let mortgage within 12 months and find better rates. Apart from that, consider investing in landlord insurance that covers rent loss, property damage, and other liabilities.

Conclusion

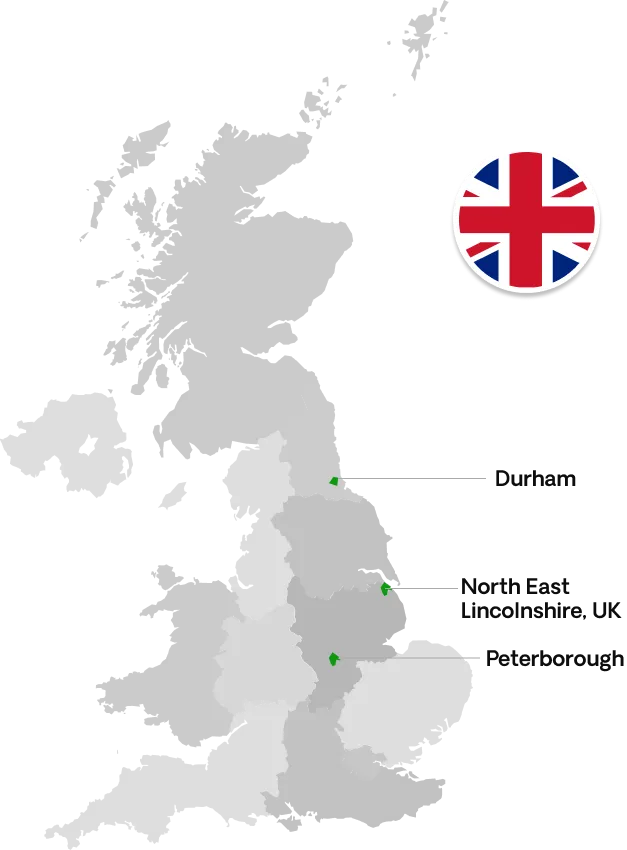

The UK rental market is full of potential sources of income, but you have to choose the best property management company for this purpose. Galaxy of Homes is a renowned property investment management company that helps you invest in the right rental property and achieve a higher return on your investment.

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091