Join Our Webinar

When deciding whether to buy property in your name or through a company, it is essential to consider the financial, legal, and tax consequences. This should occur while keeping in mind the end use that the property is going to fulfill, whether it is to fulfill your needs or to earn income from rentals. To make an informed decision, the major differences concerning ownership as an individual as opposed to a company must be identified. Also, if there is a need for further assistance, a property management company in the UK can offer help.

Both types of property ownership have their advantages and disadvantages. The advantage of owning property in your own name is that there are no complexities involved in the process, including funding. The other advantage is that this option is quite simple. On the other hand, acquiring property through a company might have its own set of advantages, which include proper investment management or enhanced security for your assets. Therefore, consider your financial objectives and make a prudent decision based on this for you to select the right method for property ownership based on your financial objectives.

Whether or not to use your own name or a company name for purchasing property is an important decision. This is because the decision you make will have an influence on how you finance the property, your tax burden, and how you will eventually dispose of it.

Most landlords are witnessing big changes in the rules surrounding the deduction of mortgage interest on their taxes. If you are in the 20% bracket, purchasing the property in your name is a good idea. But if you are in the 40% bracket, you are much better off purchasing the business through a limited company. So, you might end up gaining in a way that will improve your financial plans.

With a low tax rate, you will be able to purchase the property with the help of simple ownership by using your own name. It will benefit you more and is easier to understand. But if you own multiple properties or pay a high tax rate, it is always best to use a company name for property purchase awareness, as it will enable you to pay less tax as you expand your property business. But if you are also confused about property investment, the best property webinar in the UK will really help you out.

If you purchase properties in your own name, you are liable to pay 28% capital gains tax. On the bright side, every individual is allowed to have an annual exemption allowance of 12,000 pounds. If you purchase properties in your limited company, you are not liable to pay capital gains tax.

However, you would be liable for corporation tax at the rate of 18% with no tax relief. Then comes the question of ‘What to do?’. If you are acquiring a few properties, you would be better off acquiring properties in your personal capacity. But if you intend to acquire more properties, you would be better off acquiring the properties through the structure of a limited company.

If the property is under your name, the money obtained from remortgaging can be used for other activities like purchasing a new home, going on a vacation, and buying a new car. If the property is under the name of the company, the money obtained from remortgaging is supposed to be reinvested in real estate. If this is not the case, there may be additional tax charges.

Conclusion

Purchasing property in the individual's name makes the most sense for private consumption and simpler management of the property that is purchased. If you are looking for a long-term investment, expansion of the business, or for creating assets, the better option would be the purchase of property in the name of the company you own or are looking to set up. The judgment of whether you have to do the former or the latter depends on the financial objectives you have in mind.

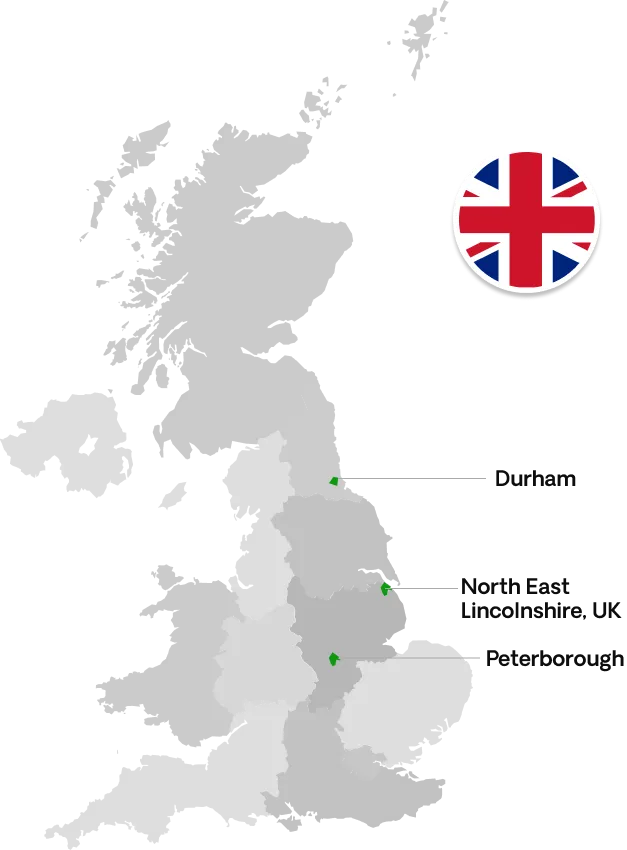

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091