Join Our Webinar

When people start thinking about investing, one of the most common questions is: Should I invest in property or stocks? Both are popular ways to build wealth, and both have advantages. The right choice depends on your financial goals, risk appetite, and time horizon.

Let’s break it down in simple terms.

Property investment usually means buying real estate and earning income through rent while benefiting from long-term price growth.

One of the biggest advantages of property is stability. Property values generally grow gradually rather than fluctuating daily. While markets may slow at times, real estate has historically recovered and continued to appreciate over the long term.

Another major benefit is leverage. Investors can purchase property using mortgages, allowing them to control a larger asset with a smaller initial investment.

Property also generates passive income through rental payments, creating a steady monthly cash flow.

Stocks represent ownership in companies. Investors earn through capital appreciation and sometimes dividends.

One major advantage of stocks is liquidity. Shares can usually be bought or sold quickly, giving investors flexibility.

Stocks also allow investors to start with relatively small amounts, making them accessible to beginners.

However, stock markets can be volatile. Prices can rise or fall sharply in short periods, which can be stressful for investors seeking stability.

Here are some important differences investors should consider:

There isn’t a one-size-fits-all answer. The best investment depends on your goals.

If you want steady income, long-term growth, and a tangible asset, property is often a strong choice. If you prefer flexibility and lower starting capital, stocks may suit you better.

Many experienced investors choose to combine both, using stocks for liquidity and property for long-term wealth building.

One principle applies to both investments: time in the market matters more than timing the market. Wealth is usually built through patience, consistency, and a clear strategy.

Property and stocks both offer opportunities to build wealth, but property stands out for its stability, leverage, and reliable income potential. With the right strategy and long-term perspective, property investment can play a powerful role in creating sustainable financial growth.

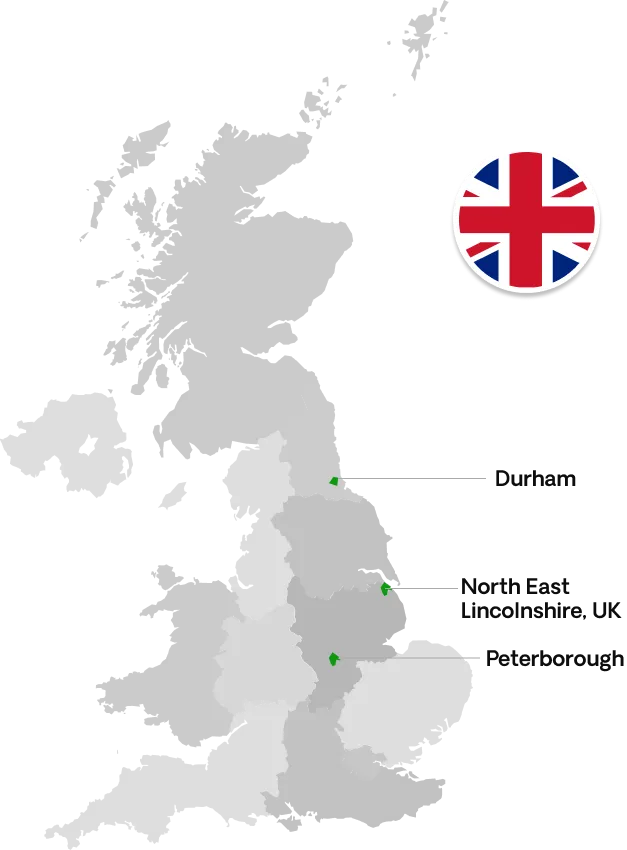

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091