Join Our Webinar

The UK rental sector is going through one of its biggest regulatory changes in recent years. The upcoming Renters’ Rights reforms are designed to improve tenant security, raise housing standards, and make renting fairer.

While the intention behind these reforms is positive, property professionals are warning that the way these changes are implemented could temporarily disrupt rental markets, particularly in London.

Understanding what is changing and how it may affect investors is essential for anyone involved in buy-to-let property.

The Removal of Section 21

One of the most significant changes under the reforms is the removal of Section 21 evictions, sometimes called “no-fault evictions.”

In the future, landlords will need to provide valid legal grounds to regain possession of their property. If a tenant does not leave, the case may need to go through the courts.

This change increases tenant security, but it also raises practical concerns. Court systems in many areas are already under pressure, and an increase in possession cases could lead to longer waiting times.

This change increases tenant security, but it also raises practical concerns. Court systems in many areas are already under pressure, and an increase in possession cases could lead to longer waiting times.

• Longer periods to resolve tenancy issues

• Higher legal costs

• Reduced flexibility in managing properties

Could Rental Supply Be Affected?

Whenever regulations increase, some smaller or accidental landlords choose to exit the market. This trend has already been seen in recent years due to tax changes and compliance requirements.

If more landlords sell their rental properties, the supply of rental homes could decrease. At the same time, demand for rental housing remains strong due to population growth, affordability challenges, and lifestyle changes.

When supply falls and demand stays strong, rents often rise. This creates challenges for tenants but can also reinforce the long-term fundamentals of the buy-to-let market.

The Market Is Becoming More Professional

One of the biggest long-term effects of regulation is that the rental sector becomes more professional. Investors who treat property as a serious business, maintain high standards, and stay compliant with regulations tend to perform better over time.

Experienced landlords and investors often adapt successfully because they:

• Work with professional letting and management teams

• Understand legal requirements

• Plan investments for the long term

In many cases, stronger regulation reduces competition from casual landlords and strengthens the position of committed investors.

What This Means for Buy-to-Let Investors

For investors, the key takeaway is not to be alarmed but to stay informed. The fundamentals of the UK property market remain strong, especially in cities with growing populations and limited housing supply.

Smart investors are focusing on:

• High-demand locations

• Well-managed properties

• Long-term rental strategies

• Professional property management

Property has always been a long-term investment, and short-term policy changes are part of the market cycle.

The Bigger Picture

The goal of the Renters’ Rights reforms is to create a more stable and transparent rental sector. Over time, this can increase trust between landlords and tenants and improve the overall quality of housing.

Most market disruptions, when they happen, occur during the transition period. Once new systems and processes are in place, the market typically stabilises and continues to grow.

Investors who understand these cycles are often the ones who benefit the most.

Final Thoughts

The Renters’ Rights reforms represent change, and change always brings a period of adjustment. While there may be short-term challenges, strong rental demand, housing shortages, and long-term capital growth continue to support property investment in the UK.

Thinking about investing in UK property? Speak to our experts today and discover opportunities in high-demand locations across the UK.

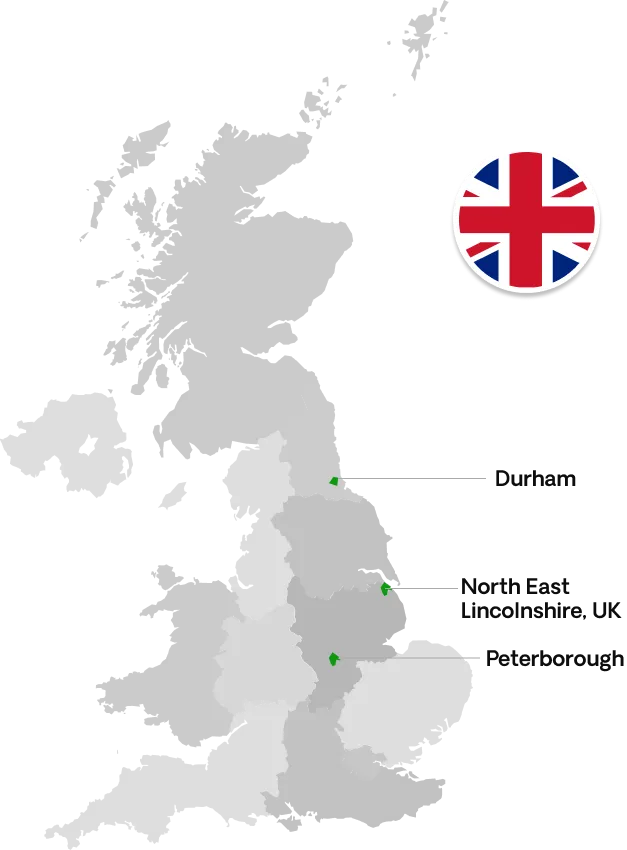

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091