Property investment can be scientific, statistical, and graphical as well. The North of the UK has become a prime area for property investors because it offers reasonable prices, strong rental demand, and notable economic growth. Unlike London and the South, where prices are high, Northern cities provide great chances for investors with much lower entry ticket size. These cities offer not just lower purchase prices but also some of the highest rental yields in the country for reliable returns. The top-notch

property investment companies in the UK help you to understand the whole process in detail. You can gain deeper insights by attending several

UK property investment webinar hosted by reputable property management companies.

To achieve success in property investment, it is essential to analyse UK house price levels relative to rental yields and market fundamentals. This approach allows investors to identify, evaluate, and interpret opportunities across markets with greater clarity and confidence. It is an aspect worth noting that as house prices escalate, so do rental costs. However, once property values reach a certain threshold, rental growth tends to be constrained by affordability and market dynamics, even as prices continue to rise. This divergence enables investors to identify regions where rental demand and income levels remain strong relative to lower property prices, presenting more favourable investment opportunities. Now let's take a look at why investing in the North of the UK is profitable for you.

Reasons Behind Investing in the North UK are Profitable

Property investment in Northern UK is gaining attention as the South faces affordability issues. The North offers strong returns and long-term potential for investors due to low entry costs, high rental yields, and growing cities.

High rental yields

Northern cities offer some of the highest rental returns in the UK. Lower property prices and strong rental demand lead to higher profits. The North is especially appealing for investors focused on cash flow. If you are still unable to understand it, you need to contact the best

Property management company in the UK.

High demands of the tenants

Northern regions of the UK are increasingly attracting working professionals relocating with their families, driven by sustained regeneration initiatives and the growth of key regional cities. This demographic typically seeks well-located, family-oriented housing, resulting in longer tenancy durations and reduced void periods. For investors, this translates into more stable occupancy, sustainable rental income, and improved long-term portfolio performance.

Rapid growth of the job markets

More global companies and UK businesses are moving into the North because of lower operating costs, skilled workers, and government support. As a result, cities like Cleethorpes, Hull, Hartlepool, and Bishop Auckland are becoming major tech, digital, and financial centers.

Diversification opportunity

To reduce investment risk, consider spreading your investments beyond the expensive and low-return markets in the southern region. By diversifying your investments across better opportunities, you can achieve higher returns on investments and balance your overall investment strategy.

Lower proper prices

Property in northern cities is an excellent opportunity because prices are much lower than in the South, especially compared to London, Manchester, Birmingham and Leeds. This lower cost makes it easier for investors to buy properties. You can get more space and better-quality homes for the same price. This affordability allows investors to build larger, more diverse property portfolios with less capital. Want to know more about it in detail? Then,

property investment companies can help you in this situation.

Ongoing renovation and infrastructure boom

Major investment projects are giving the UK North a revamped look, with some of these projects including the High Speed 2 project, redevelopment in city centers, and transport links. A few more major projects in Northern UK include – Net Zero Teesside Power project, H2NorthEast initiative, Newcastle's Helix Development & Quayside West, Humber Freeport & Renewable Energy, £120m Waterfront Developmentin Hartlepool, new Shopping center in Grimsby, Cleethorpes Seafront Regeneration, etc. All these projects have and will bring modernity and convenience to transport for people living in Northern UK. In cities, growth has created hubs of opportunity, driving innovation right across sectors.

Capital growth potential

Prices in the South have peaked in many areas. In contrast, the North is set for significant growth. Recent trends show that Northern cities are seeing faster increases in house prices. It allows investors to have a perspective on benefiting from high rental income and appreciation.

Government support and local initiatives

The UK government is committed to improving the Northern economy through the Northern Powerhouse project. This initiative includes necessary transport upgrades, strong business funding, and strategic investments in cities. These efforts are driving growth in property markets.

Conclusion

Investing in property in the North of the UK is a great choice. It presents affordable prices, strong rental yields, and strong growth opportunities. Strengthening labour markets, expanding regional economies, and large-scale regeneration projects continue to enhance the attractiveness of key northern cities, supporting both rental demand and capital appreciation. As initiatives such as the Northern Powerhouse project and many more progresses, property prices and rental demand will improve. For investors looking for good returns, lower costs, and solid future opportunities, the North of the UK is an excellent place to invest. If you are looking for the best property investments and

build property portfolio then Galaxy of Homes is there to help you out. If you want to know more about the topic then join our exclusive Property Investment Webinar.

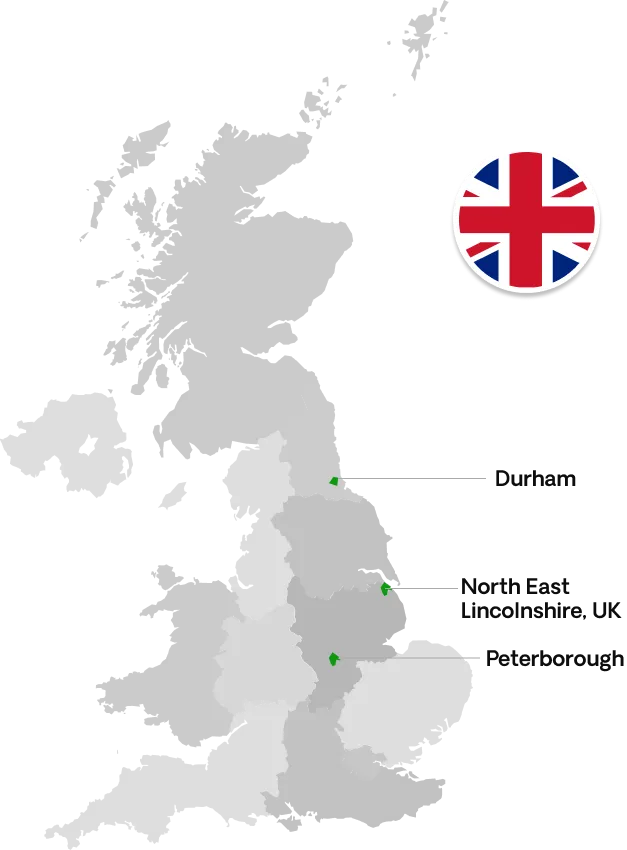

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091