Join Our Webinar

The UK rental market continues to show strong underlying support, even as the pace of change slows. According to the latest Rightmove data reported by Yahoo Finance, there is still a clear shortage of rental homes across the UK, with London remaining the most pressured market.

For buy-to-let investors, this matters more than short-term headlines. When supply stays tight and demand remains strong, rental income tends to stay reliable. That is exactly what we are seeing right now.

One of the key UK rental market trends is that growth has become calmer, not weaker.

Rents across the UK are still rising, up by around 2.2 percent compared to last year. That may sound modest, but it is actually a healthy sign. It shows the market is still moving forward, just without the sharp jumps that often create instability.

In London, rents remain at record highs. While increases have slowed, demand has not. There are still far more tenants looking for homes than there are properties available to rent. This imbalance continues to support rental prices.

In simple terms, the market is no longer racing ahead, but it is also not going backwards.

For landlords, a 2.2 percent rise in rents is positive for several reasons.

First, it confirms that rental income is still growing. Rents are not falling, and that helps protect cash flow. Second, steady growth is often easier to manage than rapid increases. Tenants are more likely to stay put when rent rises feel reasonable, which reduces turnover and void periods.

This level of growth also helps landlords absorb rising costs, whether that is maintenance, compliance, insurance, or general running expenses. It supports yields without putting too much pressure on affordability.

For long-term investors, this kind of growth is often more valuable than short bursts of higher increases.

Looking ahead, the UK rental market forecast suggests that rents are likely to keep rising into 2026, but at a measured pace.

The shortage of rental homes is not expected to disappear quickly. New supply remains limited, while tenant demand stays strong, especially in areas with good jobs, transport links, and relative affordability.

This combination points towards continued stability rather than sudden change. For investors, that makes planning easier and reduces uncertainty.

You may have seen references to a UK rental market forecast decline, but it is important to understand what this really refers to.

It does not mean rents are expected to fall. Instead, it means the rate of growth is slowing. Rents are still high, and demand remains strong, but the market is settling into a more balanced rhythm.

For buy-to-let investors, this is not a negative. A slower pace of growth often leads to fewer surprises and more predictable income.

With fewer rental properties available, landlords are facing less competition. Properties are letting quickly, and good tenants are easier to secure.

These UK rental market trends support long-term, income-led strategies. Investors who focus on the right locations and realistic yields are well placed in the current environment.

Rather than chasing rapid growth, many landlords are now prioritising consistency and stability, which the market is currently offering.

The UK rental market is not slowing down in a way that should worry landlords. It is becoming more balanced and sustainable.

A 2.2 percent rise in rents, combined with ongoing supply shortages and strong tenant demand, continues to support buy-to-let investments. For investors focused on steady income and long-term performance, the outlook remains reassuring.

If you are considering building or expanding a buy-to-let portfolio and want clear guidance through every stage of the investment journey, from understanding market trends to identifying the right opportunities, Galaxy of Homes can help.

Our end-to-end, hands-on approach is designed to support investors with practical insights, long-term strategy, and a clear focus on sustainable rental income.

Speak to Galaxy of Homes Today

Or visit www.galaxyofhomes.co.uk to learn more.

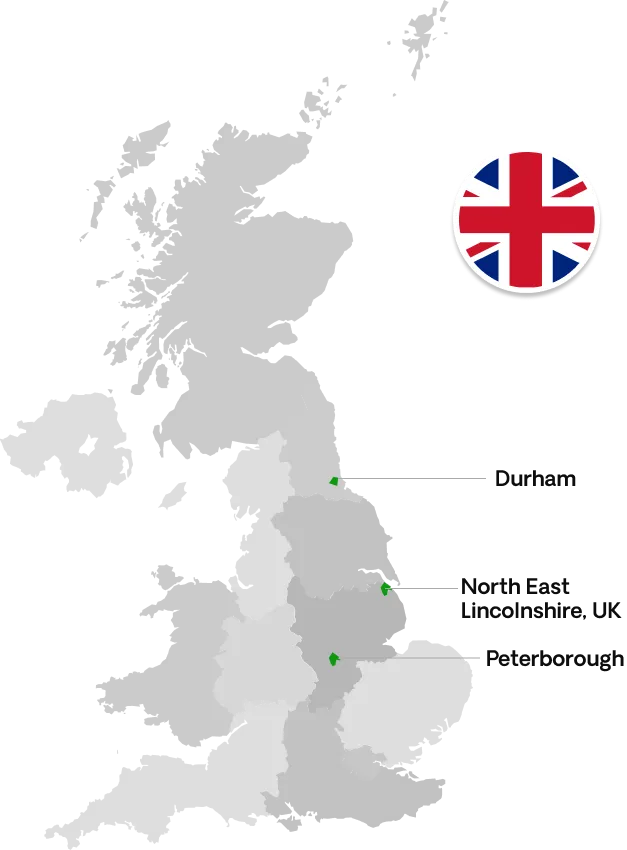

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091