Join Our Webinar

The global economy is stabilising, and investors are actively looking for where to place their money to achieve reliable returns. Inflationary pressures, combined with changing work and lifestyle patterns, are encouraging many to look beyond traditional asset classes.

These factors are bringing property investment back into focus. But is 2026 really the right time to commit capital? For many investors, property investment in 2026 may offer not just stability, but a genuine opportunity to reshape their portfolio for the future.

The property investment sector in 2026 appears to be adjusting rather than fluctuating unpredictably. Investors are moving away from chasing rapid growth and instead prioritising sustainability and long-term value.

Markets are adapting to higher borrowing costs, evolving demand patterns, and changing buyer expectations. Current property market trends suggest that strategic decision-making now matters more than timing alone.

Despite market adjustments, property continues to hold a unique position among investment assets. Its tangible nature, income-generating potential, and historical resilience make it particularly attractive during periods of economic transition.

In the context of real estate investment 2026, property rewards patience, research, and disciplined execution.

One of the biggest advantages of property investment is its ability to deliver steady value over time. Unlike assets driven purely by sentiment, property is supported by real-world demand.

Rental demand continues to rise as affordability challenges and lifestyle flexibility reshape housing choices. This has renewed interest in buy-to-let investment as a strong income-focused strategy in 2026.

Property also plays a stabilising role within a diversified portfolio. While other asset classes may react quickly to market news, property tends to move more gradually, helping smooth overall portfolio performance.

Every investment carries risk, and property investment is no exception. Understanding potential challenges in advance helps investors plan effectively and avoid costly mistakes.

In 2026, risks are less about unpredictability and more about preparation — especially for those entering or expanding within the property market.

Higher interest rates remain a key consideration. Financing terms directly impact profitability, particularly for leveraged investors. Careful mortgage planning and realistic cash-flow projections are essential.

Not all markets perform equally. While some regions benefit from population growth and infrastructure investment, others may stagnate. Understanding local property market trends is critical.

Property investment is closely tied to regulation. Tax rules, rental laws, and zoning policies can significantly influence returns. Staying informed is now a necessity for sustainable investing.

Successful property investment is rarely accidental. In 2026, effective strategies are built around data, patience, and alignment with broader market signals rather than speculation.

By aligning decisions with the real estate forecast 2026, investors can focus on stability and long-term performance rather than short-lived gains.

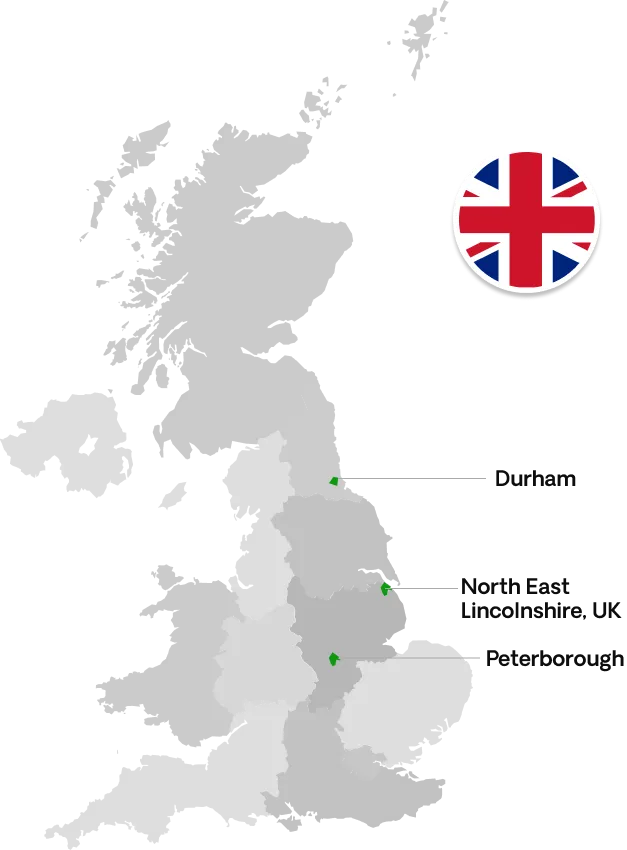

Invest where people genuinely want to live or rent. Areas with strong employment hubs, transport links, and essential services tend to outperform over time. Examples include Grimsby, Durham, and Hull in the UK.

The real estate forecast for 2026 favours patience and precision. Investors with realistic growth expectations are more likely to achieve consistent results.

A successful property investment strategy balances rental income with long-term capital growth. This reduces reliance on price appreciation alone and improves overall resilience.

Deciding whether to invest in property requires honest self-assessment. While market conditions may be favourable, individual readiness ultimately determines success.

If your goals align with long-term growth, income stability, and disciplined investing, property investment in 2026 could be a strong strategic fit.

Property investment remains a powerful tool for building long-term wealth when approached strategically. In 2026, success depends on understanding market dynamics, managing risk, and making informed decisions.

Galaxy of Homes supports investors at every stage — helping identify quality opportunities and align investments with long-term goals. With the right guidance, property investment in 2026 can be both confident and rewarding.

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091