Join Our Webinar

Recent economic data indicates that the UK economy is growing at a slower pace than expected. Weak consumer spending, cautious business investment, and ongoing cost pressures have contributed to subdued growth levels. As economic activity slows, attention has turned to the Bank of England and whether interest rate cuts may be needed to support the economy.

Interest rates have been a major topic for investors over the past two years. After a period of rate increases aimed at controlling inflation, the market is now watching closely for signals that borrowing costs may begin to fall. Economists and financial markets are increasingly expecting gradual reductions if inflation continues to stabilise and economic growth remains modest.

Interest rates play a crucial role in the UK property sector, influencing mortgage costs, investor confidence, and buyer activity. When rates are high, borrowing becomes more expensive, which can slow property transactions and reduce investor appetite. Conversely, when rates begin to fall, affordability improves and activity in the market often increases.

Lower borrowing costs can benefit property investors in several ways:

For buy-to-let investors, even small changes in mortgage rates can significantly affect overall returns, making interest rate trends an important factor when planning investments.

Despite slower economic growth, the fundamentals of the UK rental market remain strong. Housing shortages, rising living costs, and stricter mortgage affordability rules for first-time buyers continue to push many people toward renting for longer periods.

This sustained rental demand supports steady yields in many cities and regional towns across the UK. Investors who focus on high-demand locations, strong tenant demand, and realistic rental pricing often find that property continues to perform well even during periods of economic uncertainty.

In fact, slower economic periods can sometimes create opportunities. Property prices may stabilise, competition among buyers may reduce, and sellers may become more flexible. For investors with a long-term strategy, these conditions can provide favourable entry points into the market.

One of the biggest factors influencing investor sentiment is mortgage pricing. Even the expectation of future interest rate cuts can improve confidence in the property sector. Lenders may begin to adjust fixed-rate products, and investors often start planning purchases in anticipation of improved borrowing conditions.

It is important to note that interest rate reductions, when they occur, are typically gradual. The Bank of England aims to maintain stability while ensuring inflation remains under control. This means investors should focus on long-term fundamentals rather than short-term speculation.

The UK property market has historically shown resilience across different economic cycles. Population growth, limited housing supply, and consistent rental demand continue to support the sector over the long term.

While short-term market conditions may fluctuate, property remains a tangible asset that can provide both rental income and potential capital appreciation. Investors who adopt a strategic approach—focusing on location, tenant demand, and financial planning—are often better positioned to benefit from market cycles.

Looking ahead to 2026 and beyond, the direction of interest rates will remain one of the most important factors shaping investment decisions. Monitoring economic trends, lending conditions, and regional property performance will help investors make informed choices.

The possibility of Bank of England interest rate cuts in 2026 is a key development for anyone involved in property investment. Slower economic growth may present challenges, but it can also create opportunities for investors who are prepared and informed.

Understanding how interest rates influence mortgage affordability, rental demand, and property values can help investors make smarter, long-term decisions. As the market evolves, those who stay focused on fundamentals are likely to benefit the most.

Thinking about investing in UK property?

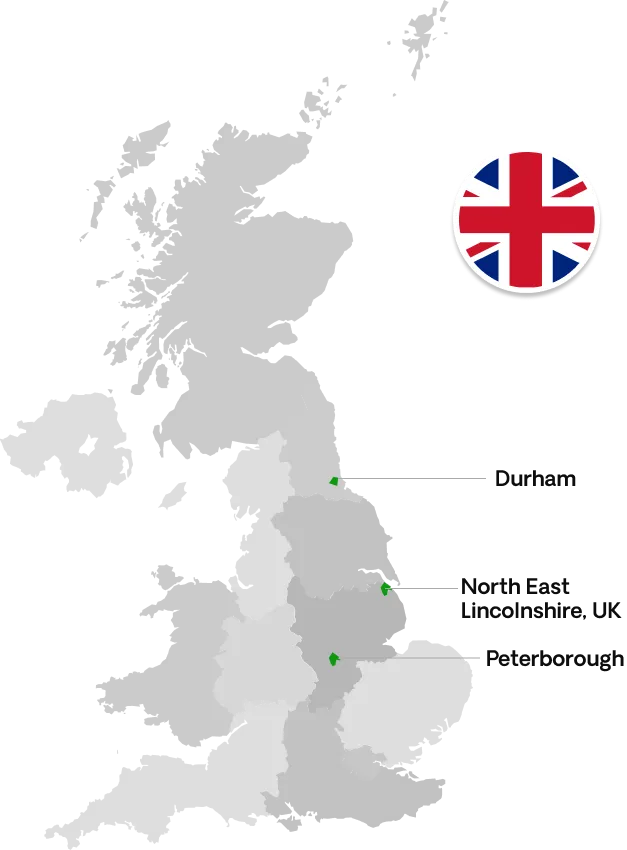

At Galaxy of Homes, we help investors identify high-yield opportunities, understand the market, and build long-term wealth through strategic buy-to-let investments.

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091