Join Our Webinar

The growing rental market shows that many people want to rent and that rental prices are likely to rise. This creates strong opportunities for landlords, especially in areas where property prices remain lower than the national average.

With population growth and the private rental sector struggling to keep pace, investors are increasingly seeking cities that offer balanced yields and long-term performance. If you are planning to invest in rental property, letting property management UK services can help ensure smooth and profitable ownership.

Many buy-to-let investors are shifting focus toward regional UK cities rather than traditional high-priced locations. These cities often offer lower property prices combined with higher rental yields.

Strong demand is driven by universities, employment hubs, and affordable living costs. When identifying the best UK buy-to-let cities for 2026, it is essential to look beyond national averages and consider local demand trends.

The strongest buy-to-let locations typically feature high rental demand, reasonable property prices, and growing local economies. Several regional towns are expected to outperform established markets thanks to population growth and regeneration projects.

Grimsby offers affordable property prices alongside strong rental demand from families and local workers. Ongoing regeneration projects are improving waterfront areas, community facilities, and essential services.

These developments increase rental appeal and support long-term growth in property values.

Located near Grimsby, Cleethorpes benefits from a strong rental market and a popular seaside lifestyle. It remains relatively affordable while offering excellent long-term potential.

Its lifestyle appeal and strong transport links make Cleethorpes a solid buy-to-let investment location.

Scunthorpe continues to attract investors due to its affordable property prices and stable rental demand from professionals and families.

Terraced and semi-detached homes are especially popular for long-term lets, making this city ideal for new landlords seeking steady yields.

Immingham benefits from strong employment in logistics and industrial sectors, driving consistent rental demand.

Though smaller than major cities, job stability helps maintain high occupancy rates and reliable rental income.

Doncaster’s rental market is growing rapidly due to expanding logistics and transport industries.

Improved infrastructure and rising average rents make it an attractive city for investors focused on strong tenant demand.

County Durham stands out in the Northeast for affordable housing combined with high rental demand, particularly around Durham University and employment centers.

The low entry costs make it ideal for investors looking to build or expand a property portfolio.

Successful buy-to-let investing requires balancing affordability, rental demand, and long-term growth potential.

Focus on cities with strong employment, universities, good transport links, and regeneration activity. Always compare property prices against realistic rental income to ensure strong returns.

The best buy-to-let locations in the UK for 2026 will combine affordability with growing demand and economic development.

Regional cities are increasingly outperforming high-cost southern markets, offering better yields and stable tenants.

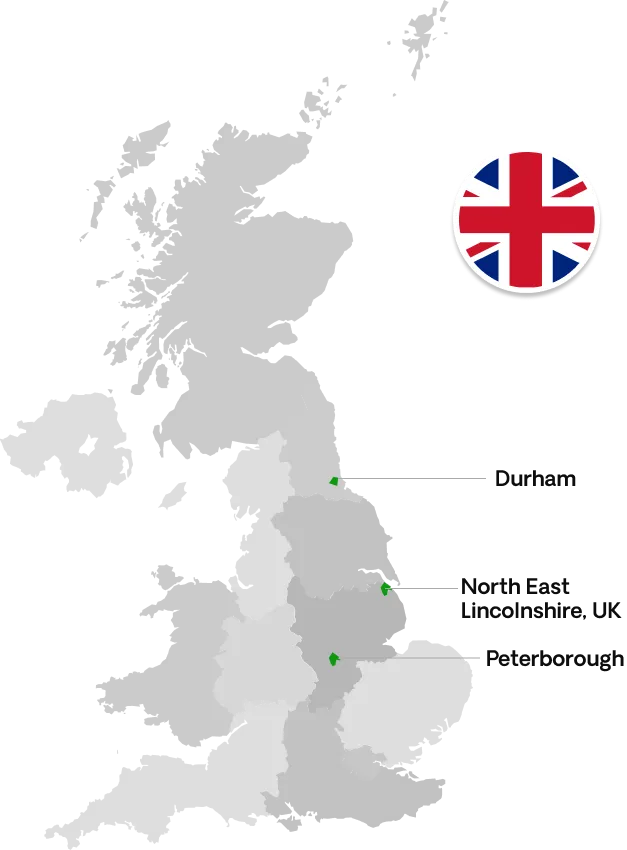

At Galaxy of Homes, we help investors identify high-potential cities, assess real rental demand, and invest confidently. Whether you are purchasing your first rental property or growing your portfolio, our expert guidance ensures long-term success.

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091