Join Our Webinar

The UK Budget outlines the government's annual funding and spending plan. It includes the rates at which taxes will be charged, the allocations of where the money will be spent, and how much the government will borrow. The Budget provides strong support for essential services, including healthcare, education, defense, and social welfare, demonstrating the government's commitment to the nation's well-being and growth. If you are planning to invest in property in the UK, a property management company in the UK can help you.

The Budget is important for balancing income and spending but it also has a bigger impact. The Budget promotes economic growth, job creation, and shapes inflation. Through taxation, investment incentives, and funding specific programs, it shapes the lives of individuals, businesses, and the economy as a whole. For this reason, it is essential to ensure short-term economic stability and clearly support long-term national goals. In this article, we will provide some information about the UK's Budget.

The UK Budget outlines the government's annual tax collection and spending plan. It affects public services, accelerates economic growth, and supports financial stability in the country.

The National Insurance and income tax thresholds will remain unchanged for three more years. This means more people will move into higher tax bands. From April 2027, people under 65 can put 12,000 pounds a year into cash ISAs, with an additional 20,000 pounds allowed for investments. Starting in April, ordinary and upper tax rates on dividend income will rise by 2 percentage points, and all rates on savings income will increase.

Homes in England worth more than 2 million pounds will have to pay a higher council tax. The surcharge will range from 2,500 to 7,500 pounds. This change is due to the recent revaluation of properties in tax bands F, G, and H. Also, starting in April, the tax on rental income will increase by 2% points.

Want to understand more about housing or property? The leading UK property investment company is perfect for you.

The employer National Insurance thresholds will remain the same until 2031. This will increase costs as wages go up. Starting in 2029, the tax exemption for small packages from overseas retailers costing less than 135 pounds will end to support UK businesses.

In April, the remote gaming duty on online casino betting will jump from 21% to 40%. The general betting duty on online sports betting will also rise from 15% to 25% in April, but horse racing will not face this change.

The Office for Budget Responsibility (OBR) has revised its forecast for the economy in the UK. The growth forecast for this year has been marginally revised upwards from 1% in March to 1.5%. The forecast for 2026–2029 remains at 1.5% each year, lower than the previous forecast of 1.8%.

This year, inflation is expected to average 3.5%, then drop to 2.5% next year, and return to the government's target of 2% by 2027.

The UK Budget is an important tool that helps to fuel the economy, improve public services, and address major challenges like recovery from the pandemic, inflation, and climate change. The UK Budget includes tax relief, strong support for businesses, and increased investment in infrastructure to boost growth and build a sustainable future.

The 5p fuel duty reduction will apply to petrol, and diesel will remain intact until September 2026, with a planned increase afterward. From 2028, electric vehicles and plug-in hybrids will be subject to a mileage-based tax.

Rail fares in England will not increase next year for the first time since 1996. Additionally, premium cars will now be excluded from the Motability scheme for those on certain disability benefits.

The Treasury has announced that green charges will be removed from energy bills and instead paid through general taxes. This change will save households 88 pounds each year. Stopping the program that helps low-income families insulate their homes will save an additional 59 pounds.

The UK Budget is essential as it guides the country’s finances, outlines economic plans, and supports the goals of the government. The way in which taxes are raised, how money is spent, and how much is borrowed has a direct impact on people, businesses, and the overall economy.

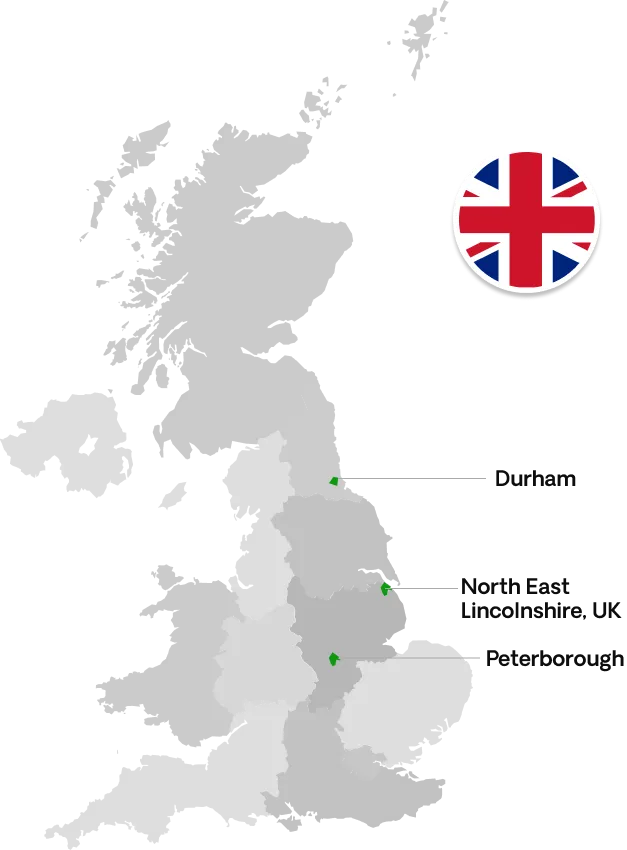

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091