Investment in property is one of the most powerful methods for making money, but it does come with risks: market fluctuations, interest rate changes, and ongoing maintenance costs being a few. You need to be crystal clear on your risk tolerance-that is, the ability to bear possible losses-before you start investing. It will drive your property selection and how you address the market fluctuations while keeping both your financial and emotional objectives in mind. Buying the best

buy-to-let property in the UK will let you get the most out of your property.

Risk profiling goes much beyond mere number crunching; it represents a thorough comprehension of one's financial landscape, as well as one's aspirations and mindset. While some investors get off on high-risk, high-reward ventures, such as property development or flipping, others derive much-needed security from stable, long-term rentals that simply deliver consistent income. .

You need a property investment strategy that will not only make you feel safe but also hold the possibility of giving you phenomenal returns, and that calls for an in-depth and detailed analysis of your financial capability, investment experience, and emotional response toward risk. Knowing your limits empowers you to avoid unnecessary financial stress and enables you to make assertive, informed decisions in a fluctuating market. .

Assess Your Risk Tolerance for Property Investment in Various Ways.

Before investing in property, it's essential to know your risk tolerance-that is, how much financial risk you can handle. Property investment may be rewarding but not without carrying risks like the fluctuations in markets and the costs of maintaining the property. Knowing your ability to take risks will help you to make correct decisions that will align with your financial goals. Here's a simple guide to assessing it.

• Understand the risk tolerance.

Successful negotiation of investments involves an understanding that risk tolerance is not only about your financial ability but also your emotional one. Some investors hardly have a problem with the ups and downs of the market, while others would rather take conservative positions. You would be in the best place to decide on the right type of property for you, either a steady income generator or a high-return development project. With the best

UK property investment, you can avoid any risks.

• Understand your investment goals.

Clearly define your goals: Are you seeking stable rental income, long-term capital growth, or quick profits by flipping? Your aim determines your acceptable risk level. For instance, rental properties have steady, moderate returns with low risk, while development projects or commercial properties offer the possibility of making higher profits but with greater uncertainty.

• Assess your knowledge and experience.

Take an inventory of your expertise in real estate markets, finance, legal considerations and property management. In general, the more you know, the less your perceived risk. Sophisticated investors have the confidence to participate in complex transactions and ride out market cycles. Novice investors can be very successful by sticking with simple, low-risk investments such as residential rentals.

• Assess market and property type risks.

First, understand the volatility and stability of the market to which you are targeting-urban or rural, residential or commercial. Different markets and property types bear different risks. Whereas commercial real estate depends a great deal on demand by tenants, residential properties usually are pretty steady in that respect. Make your decision based upon your comfort and confidence level with the dynamics of the market.

Conclusion

Your risk tolerance for investment in property is a balance between your financial capability, emotional comfort, and long-term goals. When these are clearly understood, then it is easier to choose the right type of property, method of financing, and strategy that assures sustainable and stress-free investment growth. Knowing your limits regarding risk means you can invest smarter, not just braver.

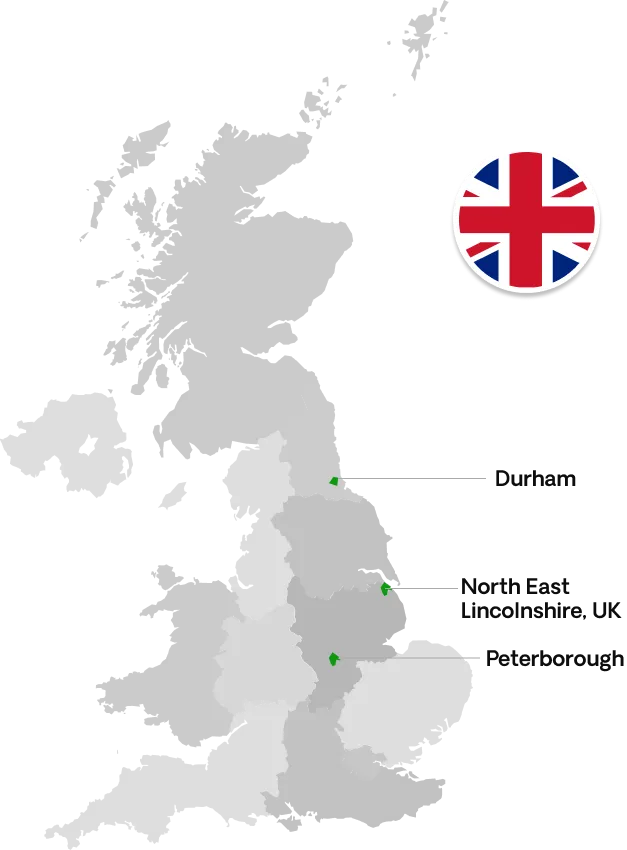

+44 1733973269

+44 1733973269 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk 28 Tesla Court, Peterborough PE2 6FL, UK

28 Tesla Court, Peterborough PE2 6FL, UK

+44 1472806900

+44 1472806900 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

Rear of 231-233 Heneage Road, Grimsby DN32 9JE. UK

+44 1915878129

+44 1915878129 sales@galaxyofhomes.co.uk

sales@galaxyofhomes.co.uk Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

Novus Business Centre. Judson Road, North West Industrial Estate, Peterlee, SR8 2QJ

+91 9748332338

+91 9748332338 accounts@galaxyofhomes.co.uk

accounts@galaxyofhomes.co.uk 9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091

9. Victoria Park, GN 37/2. Sector V. Bidhannagar. Kolkata. West Bengal 700091